COLLECTION of Higher Ed news items – highlighting problems & proposed solutions

[ Fact sheet / “Key” News Articles, compiled by Gordon Wayne Watts (GordonWatts.com /

gordonWAYNEwatts.com) Monday, 11/25/2019; Updated Friday, 03 April 2020 ]

The following paper, here, is a collection of relevant Higher Education news items, which show two things:

(#1) PROBLEM: First, and foremost, this should scare the pure living daylights out of the reader (you), and clue you in that there's a “real problem” brewing—which has even resulted in a new “Student Debt suicide” phenomenon![a.]

(#2) SOLUTION: Secondly, however, while many solutions are bandied about, we hope to show that what lawmakers have been doing HASN'T worked, & suggest that Alan Collinge's article (below) might be the only thing that works. Alan M. Collinge, a retired rocket scientist, is quite smart (Google him), but in the mean time, let's look at his scientific analysis—a “middle-ground” solution—not on either extreme.[b.]

[a.] Source: “1 in 15 borrowers has considered suicide because of student debt, survey says,” by Alex Tanzi, The Washington Post, May 5, 2019, LINK: https://www.WashingtonPost.com/business/economy/student-debt-has-increased-almost-61-billion-since-end-of-2017-survey-shows/2019/05/05/cf923122-6f90-11e9-8be0-ca575670e91c_story.html

[b.] Source: “A key Republican Education Department official and Trump Appointee, A. Wayne Johnson, recently resigned his position and made a radical call for student loan cancellation. Johnson noted that the lending system was “fundamentally broken” and called for loan cancellation for all loan holders up to $50,000. He also called for a tax credit of the same amount for those who have already repaid their loans. Interestingly, Johnson’s plan sounds very similar--and in some ways even more generous--than what presidential candidate Elizabeth Warren is proposing.

This is strong stuff coming from a Republican, particularly one who ran the federal lending program. Johnson’s comments could indicate that this problem is far worse than the Department of Education has said publicly. He noted that he came to this conclusion after having a “firsthand look” at defaults, which we already know are running at about 40% for 2004 borrowers. And those borrowers were only borrowing one-third of what students are borrowing currently. One can only wonder how bad the internal projections must be for more recent students.” [Small quote, used under “Fair Use” for commentary, criticism, & research]

Source: “One inexpensive and easy fix for the student loan problem,” by Alan Collinge, The Washington Examiner, November 29, 2019, LINK: https://www.WashingtonExaminer.com/opinion/op-eds/one-inexpensive-and-easy-fix-for-the-student-loan-problem

Alan reminds us that “any cancellation program would be administered by the Department of Education, which has a well-documented history of bungling such programs,” as I prove below in my PSLF news item (and let's not forget that Sec. of Ed., Betsy DeVos nearly got arrested for failure to forgive certain loans obtained under fraud, when she disobeyed a recent Federal Court order), so the Dept. of Education can not be trusted by any of us (even myself, a right-wing Conservative Republican who supports most of the policies of President Trump, who appointed DeVos).

Alan suggests that returning bankruptcy equality to collegiate loans, as provided by H.R.2648 and S.1414, currently enrolled in Congress, would be “a far less expensive solution than Warren's. At first, there would be an unavoidable spike in filings, but bankruptcy scholar Robert Lawless has estimated that in the “steady-state”, annual discharges would come to less than $3 Billion per year,” and that “we would get a much more efficient and well suited outcome. [] Not to mention: The Founders would agree.”

Is Alan Right? – let's see...

Without bankruptcy defense, all the other “cool” things we want will lack “teeth” – i.e., enforcement motivation. For example, [#1] PSLF (Public Service Loan Forgiveness), [#2] Dept of Ed's “discharge under Borrower Defense to Repayment” program, [#3] Trump's request for Loan Limits legislation using tax$$ to make/back college loans, [#4] prohibitions against states taking away driver's licenses, professional licenses, for student loan default, etc., all will have no motives to compel enforcement. [#5] Repeated requests from lawmakers, policymakers, press, and consumer advocates, etc. for colleges to “be fair” in the tuition they charge students are ignored.

[#1] QUOTE: “The government made a simple promise to student loan borrowers - work in public service for 10 years, make valid loan payments for 10 years, and the Education Department would forgive the leftover balance on the loan. The program is called Public Service Loan Forgiveness. But borrowers have complained for years that the process has not worked as advertised...As of this summer, nearly 29,000 applications for Public Service Loan Forgiveness have been submitted and processed. But of those 29,000, just 289 applications were approved. That's a 99 percent denial rate. Now, some experts say the acceptance rate is sure to improve. It's early. But it's also hard to see how it could get much worse either.”SOURCE: “Data Shows 99% Of Applicants For A Student Loan Forgiveness Program Were Denied,” by All Things Considered program, NPR, September 21, 2018, LINK: https://www.npr.org/2018/09/21/650508381/data-shows-99-of-applicants-for-student-loan-forgiveness-denied

[#2] QUOTE: “As part of the 2018 court ruling on the collapse of for-profit college chain Corinthian Colleges, the federal judge ordered DeVos and the Department of Education to cease all collections activities on federal student loans used to attend Corinthian schools, given that they would likely be eligible for discharge under Borrower Defense to Repayment. [] DeVos ignored the ruling...” SOURCE: “Judge Threatens Betsy DeVos With Jail In Student Loan Case,” by Adam Minsky, FORBES, Oct 8, 2019, LINK: https://www.forbes.com/sites/adamminsky/2019/10/08/judge-threatens-betsy-devos-with-jail-in-student-loan-case/

[#3] QUOTE: “President Trump released a 10-point plan to reform the Higher Education Act, which is the primary legislation that governs higher education...Among others, his goals include: [] reduce the cost of higher education;...The administration calls for limits on federal student loan borrowing and more guidance for borrowers on how likely they are to repay student loans...Potential Rationale: Curb the rise of college tuition. Limit the rise in student loan debt. [] Potential Impact: Lower education costs can mean less student loan borrowing.” SOURCE: “Trump Proposes Limits On Student Loan Borrowing,” By Zack Friedman, FORBES, Tue. March 19, 2019, LINK: https://www.Forbes.com/sites/zackfriedman/2019/03/19/trump-proposes-limits-on-student-loans

[#4] QUOTE: “Meanwhile, the number of Americans who need a license to work has almost quadrupled since the 1950s, with nearly a fifth of the nation’s workforce licensed...Fortunately, lawmakers are increasingly looking to protect borrowers from losing their licenses. On Thursday, Sens. Marco Rubio (R-FL) and Elizabeth Warren (D-MA) reintroduced the Protecting JOBs Act. Under the bill (S. 609), any state that receives federal funding through the Higher Education Act would be barred from denying, suspending, or revoking an occupational license or a driver’s license “solely” because a borrower defaulted on their federal student loans. [] “It is wrong to threaten a borrower’s livelihood by rescinding a professional license from those who are struggling to repay student loans, and it deprives hardworking Americans of dignified work,” Sen. Rubio said in a statement. “Our bill fixes this ‘catch-22’ and ensures that borrowers are able to continue working to pay off their loans, instead of being caught in a modern-day debtors’ prison.”” SOURCE: “New Bill By Rubio, Warren Would Stop States From Suspending Job Licenses Over Unpaid Student Loans,” by Nick Sibilla, FORBES, Mar 4, 2019, LINK: https://www.forbes.com/sites/nicksibilla/2019/03/04/student-loan-debt-can-mean-losing-your-license-to-work-a-new-bill-by-rubio-and-warren-would-stop-it/

[#5] QUOTE: “If the Department of Education were seeing a material, financial loss with loan defaults, they likely would be far more assertive about the reasons NOT to raise the loan limits…and this would provide a critical check on the process.” – “Therefore, Congress continues to rubber-stamp these legislative efforts, and the schools quickly raise their tuition to bump up against the new lending ceilings.”SOURCE: “Why College Prices Keep Rising,” By Alan Michael Collinge (writer) and Peter J Reilly (FORBES Contributor), FORBES, March 19, 2012, LINK: https://www.forbes.com/sites/peterjreilly/2012/03/19/why-college-prices-keep-rising/ EXPLANATION: In case you didn't get it, advocates and others of “good moral character” keep asking nicely for colleges to lower tuition to affordable levels, but since students can't declare bankruptcy (except under the near-impossible 'Undue Hardship' standard), the Dept of Ed isn't seeing a material loss, and has NO motive to ask lawmakers to lower loan limits, which would (of course) prevent students from borrowing so much, and, in turn, force colleges to lower tuition to affordable levels.

These 5 things aren't happening because Bankruptcy (the “Economic Second Amendment”) is lacking as a defense available to student borrowers: The Register is Conservative, and we support H.Res.675 [116th Congress (2019-2020)], a Resolution expressing the view that Student Loan Forgiveness (or "Free College") are antithetical to American foundational values of self-responsibility & opportunity. HOWEVER, if Lawmakers could pass (263-171 in the House) the "Mortgage Bailout" (aka: "Emergency Economic Stabilization Act of 2008") outright giving a "Liberal Free (Corporate) Handout" of Seven-Hundred Billion ($700,000,000.oo) Dollars (not counting another $250 Billion and $350 Billion in Sec.115) to companies who made bad decisions, and still have a "Bankruptcy Safety Net," the least they could do is return said safety net to student 'loans'. LIBERAL Lawmakers need to offer relief for taxes dressed up as loans to Student Loan Borrowers, and besides this tax-cut for the middle-class, they need to enact the spending cuts that Trump requested, which would drive down student debt and costs of college, as unlimited subsidies stopped "propping up" a Higher Ed Bubble (which looms larger than the 2008 Housing Bubble, as it lacks Bankruptcy as a Free Market check on excessive taxing/spending). Remember, my Conservative peeps: The 2ND Amendment is what protects the 1ST- & ALL others! – but even worse things will happen if we fail to enact Bankruptcy Equality for Student Loans, e.g., H.R.2648 and S.1414 — 116th Congress (2019-2020), "A bill to provide bankruptcy relief for student borrowers," – See below...

With GOP lawmakers REFUSING to sign on to H.R.2648 and S.1414, we will likely:

ANGER VOTERS – and: Lose the Senate like we lost the House {{{and for the same reasons: Unnecessarily angering MILLIONS – if not HUNDREDS of Millions of Americans, unnecessarily, as 44 Million have oppressive student loans, and another 30—40 Million are cosigners, family, or friends, and, as I this goes to publication, about twenty-six (26%) percent of ALL recent student loans default in the FIRST FIVE (5) YEARS alone, and the figure is probably closer to 50% or 75% over the lifetime of the loan: See point “(G)” below}}}: Even when a large majority of the public favours bankruptcy—even if not outright “free” college—as new research now confirms is happening: “...economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence,” according to a new Princeton paper: “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens,” by Martin Gilens and Benjamin I. Page, Perspectives on Politics, Volume 12, Issue 3, pp. 564–581, September 2014, American Political Science Association 2014, DOI:10.1017/S1537592714001595

Alienate / Anger Democrat lawmakers, whose votes we WILL need to get Trump's loan limits bill, and other (non-economic) bills passed into law.

OTHER facts to consider:

(A) RED ALERT!! >> “Small businesses are the backbone of the U.S. economy and account for approximately one-half of the private-sector economy and 99% of all businesses...Based on our model, an increase of one standard deviation in student debt reduced the number of businesses with one to four employees by 14% on average between 2000 and 2010. The effect on larger firm formation decreased with firm size, which we interpret to mean that these firms have greater access to outside capital.” (Source: “WORKING PAPER NO. 15-26 THE IMPACT OF STUDENT LOAN DEBT ON SMALL BUSINESS FORMATION,” by Brent W. Ambrose (Pennsylvania State University and the Federal Reserve Bank of Philadelphia), Larry Cordell (Federal Reserve Bank of Philadelphia), and Shuwei Ma (Federal Reserve Bank of Philadelphia), Research Department, Federal Reserve Bank of Philadelphia, July 2015, LINK:

https://www.PhiladelphiaFed.org/-/media/research-and-data/publications/working-papers/2015/wp15-26.pdf Emphasis added in bold-face and underline, for clarity; not in original.) COMMENTARY: The impact of student loans includes (#1) Restricted Consumer Spending, this above, (#2) Delaying adult milestones (delaying, marrying, buying a home, having children, etc.), and (#3) Inflating the cost of everyone's education (which places national security in jeopardy, as an over-indebted, under-educated populace is bad for national security, economy, and socioeconomic & international welfare of the United States.) (#4) BONUS: Interest, alone, on student loan debt is about $100 Billion/year – money taken OUT of our local communities, e.g., home improvements, consumer goods/services, consumer savings/retirement. This should be important for supposedly Conservative Red State GOP Republicans, who claim to value our Small Businesses.

(B) PAST METHODS WORKED—The CLAIM : Bankruptcy is FAR less expensive solution than the current “Free College” or “Loan Forgiveness” plans touted by Democrat Presidential candidates, Bernie Sander, Elizabeth Warren, etc.[***] At first, there'd be an unavoidable spike in filings, but bankruptcy scholar Robert Lawless estimates that in the “steady-state,” annual discharges would plateau & come to less than $3 Billion per year: “This is also not a question of cost. Allowing the most extreme cases of student loan debt to be forgiven in bankruptcy would only cost the government $3 billion, representing only 3 percent of the total amount of loans doled out by the government each year. This is far less than is expected to be forgiven by other relief programs like Public Service Loan Forgiveness and Income-Based Repayment (or “Pay As You Earn”), in service of a policy that is squarely targeted at distressed borrowers.” (Source: “No Recourse: Putting an End to Bankruptcy’s Student Loan Exception: How student loans are treated differently than almost every other form of debt incurred by American households.,” by Bob Lawless (U of Illinois), Demos, posted in RESEARCH, November 24, 2015, LINK 1: https://www.Demos.org/research/no-recourse-putting-end-bankruptcys-student-loan-exception LINK 2: https://www.Demos.org/sites/default/files/publications/Bankruptcy-%28mark%29.pdf NOTE: Italics in original, © 2019 Demos, Small quote used under “Fair Use”) COMMENTARY: The estimated cost of returning bankruptcy to student loans is less than $3 Billion per year in annual discharges. This is far less than annual government profits on the loans. For proof of this theorem, please see the Harvard Law Review documentation, linked below, which shows that almost NO discharges happened back when bankruptcy WAS legal, from which we can infer a low, $3B figure. By contrast, the sheer number of loans, SIZE of each loan, and fact that many (if not most) are “in distress,” clearly implies a huge profit margin, which is basically a bubble ready to burst. [***] The 'Loan Forgiveness' advocated by Bernie Sanders has historical precedent, in the JudeoChristian Bible, no less: “1 At the end of every seven years you shall grant a release of debts. 2 And this is the form of the release: Every creditor who has lent anything to his neighbor shall release it; he shall not require it of his neighbor or his brother, because it is called the LORD’s release…” (HOLY BIBLE, Deuteronomy 15:1-2a, NKJV, see also Deut 15:1-11, and Leviticus 25:13: “In this Year of Jubilee, each of you shall return to his possession,” re: JUBILEE FORGIVENESS)

** PROOF: Dr. Lawless' calculations are reasonable when considering that, even in a “worst case” scenario, even if every student loan borrower filed for—and got—full bankruptcy discharge, this would cost taxpayers almost nothing: Thanks to Obama-era regulations, the Federal Government is now the SOLE lender (and SOLE OWNER!) of all current student loans, having purchased almost all of existing student loans. In plain English, this means that, as “Sole Owner” of almost all student loans, the Taxpayer Dollars OWN (and don't “guarantee”) the loans, thus do not need to “pay off” the loans: Taxpayers paid IN FULL these loans when the student took out the loan. So, if EVERY SINGLE STUDENT filed bankruptcy (and got it—very unlikely), there would be slight “dip” in repayment (since most are NOT paying, but are in default), and this would scare the lender (the U.S. Dept of Education) into drastically lowering loan limits—thus saving, long-term, TRILLIONS of dollars. (Failure to return Student Loan Bankruptcy would allow the continued “bleeding to death” of taxpayer dollars, as we continue to lend HUGE AMOUNT$ to students who CAN'T pay back, but have NO choice BUT to take out said loans, in order to get an education, with illegally-price-gouged monopoly-inflated tuition and costs of college: Bankruptcy is the needed “Free Market” check on these abuses.)

THE 'MATH' behind said PROOF: “As of July 8, 2016, the federal government owned approximately $1 trillion in outstanding consumer debt, per data compiled by the Federal Reserve Bank of St. Louis. That figure was up from less than $150 billion in January 2009, representing a nearly 600% increase over that time span. The main culprit is student loans, which the federal government effectively monopolized in a little-known provision of the Affordable Care Act, signed into law in 2010.” (Source: “Who Actually Owns Student Loan Debt?,” by Sean Ross, INVESTOPEDIA, Updated Jul 30, 2019, LINK: https://www.Investopedia.com/articles/personal-finance/081216/who-actually-owns-student-loan-debt.asp) In fact, almost all student loans are owned – not guaranteed – by the taxpayer: “Most student loans – about 92%, according to a December 2018 report by MeasureOne, and academic data firm – are owned by the U.S. Department of Education.” (Source: “2019 Student Loan Debt Statistics,” by Teddy Nikiel, NerdWallet, December 20, 2019, LINK: https://www.NerdWallet.com/blog/loans/student-loans/student-loan-debt) Even assuming $2 Trillion, a slightly high estimate, the remaining 8% guaranteed (not owned) would only cost taxpayers $160 Billion, but even this is high because only about half of the loans are outstanding (bringing down the estimate to about $80B), many students having paid off their loans several times over (making the government a pretty profit). Of those remaining, only about HALF of those are in default (see the 40% figure for the 2004 Brookings paper, above, and know that current students borrow about 2—3 times as much, guaranteeing that OVER HALF of all student are (or will be) in default: Taking half of $80B yields about $40 Billion total cost for taxpayers,even if EVERY SINGLE STUDENT en masse filed (and was granted) bankruptcy. Since most students would not file for bankruptcy (just like most of the about 100 Million gun owners DO NOT go on shooting sprees for reasons besides genuine “self defense”), this means that, maybe 5 or 10 Billion dollars would be at stake, but even this figure is high: Federal Bankruptcy Courts would NOT grant “total” bankruptcy to student borrowers, unless they were VERY indigent & poor: Most students would have to pay back “something,” thus the 5 or 10 Billion would be knocked down to about $3 Billion figure initially cited by Dr. Robert “Bob” Lawless (U of Illinois), Demos, and posted just above, thus supporting Dr. Lawless' $3 Billion/year estimate. CONCLUSION: Returning bankruptcy to Student Loans might cost $3—4 Billion Dollars. Failure to do so allows taxpayers to BLEED TO DEATH, as we force untold TRILLIONS into rich colleges/banks, using “students as a conduit.” Moreover, history supports Dr. Lawless' estimate, here:

(C) PAST METHODS WORKED—The PROOF : Back when we has student loan bankruptcy, as an option, there was ALMOST NO discharge in bankruptcy. (Key concept: An armed society is a polite society, and everyone was “armed” with bankruptcy rights.) "By 1977 only .3% of student loans had been discharged in bankruptcy." LINK: https://www.linkedin.com/pulse/history-student-loans-bankruptcy-discharge-steven-palmer ** "Debunking the first premise is the fact that by 1977, under 0.3% of the value of all federally guaranteed student loans had been discharged in bankruptcy...(See H.R. REP. NO. 95-595, at 148 (1977).)" Harvard Law Review, LINK: http://HarvardLawReview.org/wp-content/uploads/pdfs/vol126_student_loan_exceptionalism.pdf

(D) PAST METHODS WORKED— Damning[*-*] PROOF : When speaking with one intelligent Higher Education staff of an unnamed congressman, he said that if “Standard Consumer Protection” bankruptcy was returned to Student (College) Loans (like in the past, instead of the near-impossible “Undue Hardship” standard), that there'd be a “rush” on bankruptcy filings (and so did his boss, the Congressman, himself, an attorney who did bankruptcy filings, and said they're super easy to do). MY ANSWER: Although Dr. Lawless' estimates (A, above), and historical precedent/proof (B, above), pretty-much show that it's not likely, we must be “intellectually honest,” and consider a “worst-case scenario,” to be fair, OK? [*-*] “Damning PROOF” is read “in context,” and to mean “Overwhelming,” not a curse or a cuss word. But as this proof is overwhelming, the English Language doesn't have an appropriate descriptor adjective, so this is the closest we can get.

PROOF – Short Answer: Even someone filed (a difficult process for non-lawyers) -- *and* even assuming bankruptcy court granted 100% discharge (possible, but not likely, as courts usually require some portion of the debt repaid), this would not be unlike the Emancipation Proclamation: "Economic" reasons for slavery existed, remember? However, even over the 'hue and cries' of angry Southern Businessmen (including Cotton plantation owners), that lack of "free labour" provided by the slaves would crash the economy, put them out of business, etc., guess what? It didn't happen. The nation recovered just fine.

PROOF – Long Answer – with Facts & Documented sources: Regarding my claims, above, that we don't face a greater financial threat if we "free the debt slaves," I went back and looked for exact facts/figures, and documentation:

Total Free Population 27,489,561

Total Slave Population 3,953,760

Grand Total 31,443,321, Meaning that the Civil War era slaves comprised 12.57% of the U.S. Population

* Source: https://www.google.com/search?client=opera&q="3%2C953%2C760"+"27%2C489%2C561"

However, the current batch of "Debt Slaves" comprise roughly 44 Million Americans (documentation below), and as current U.S. Population is about 327.2 million (2018 figures as current as I can quickly get, but the United States 2019 population is estimated at 329,064,917 people at mid year according to UN data), our current debt slaves are only about 13.37% of total population, only *slightly* more. But, since "freeing" these slaves would only free them from their debt (and not relieve them from giving their *entire* life as servitude), and since only some would file for bankruptcy (and since even still, only *some* of the debt would likely be forgiven, as Bankruptcy Court usually requires some -- perhaps half -- of the debt to be repaid), it's obvious that we would not crash the U.S. Dollar if we freed ALL those 44 Million:

* Source: https://www.google.com/search?client=opera&q=current+us+population

PROOF–“MORAL” Answer (for religious & God-fearing readers –Atheists, you can skip this) – Respectfully, 2 things:

First, and most-importantly, when Federal Lawmakers removed the bankruptcy option from **existing** loan contracts, we violated our word to The Lord (or, for atheists, we lied and are morally bankrupt). So, the unnamed (and intelligent) Higher Education staffer's concern of crashing the "financial" dollar, while a valid claim, respectfully, is **not** comparable to the current state of affairs: We crashed our "moral" capitol before God when we lied to Americans.

Secondly, however, this reminds me of when Moses sent out twelve (12) spies to take possession of "The Promised Land." (See e.g., NUMBERS, chapters 13 and 14 of the Pentateuch, e.g., the Old Testament, accepted by ALL Jews, ALL Christians, and I think (but am not sure) most Muslims. (Even for our atheist friends, I offer this historical account to make a point, assuming it is literally and historically true, and also as a sort of parable, even still.) I'm asking Representative Spano to pass H.R.2648 and introduce the loan limits bill that President Trump and myself have long requested (and that Sec. Betsy DeVos and Congressman Spano have both said they like; see her recent 11-27-2018 speech last year, and ask Rep. Spano to confirm his views on this) because our current trajectory is dangerous. Yes, there's risk with my suggestion (just as there was a risk for the Israelis to go and take possession of the promised land). But 10 of the 12 spies basically said they were afraid. See here, if you don't have your Bible handy: https://www.BibleGateway.com/passage/?search=Numbers%2013-14&version=KJV;NIV

My point? While I don't know the exact circumstances that made it possible for the Israeli army to capture Canaan, the so-called "Promised Land," I'm guessing there was some festival, and the Canaanites were drunk (and thus vulnerable). Regardless of whether my "guess" is correct, it's a **FACT** that they were vulnerable then, but NOT the following day (when the Israelites went up and got badly defeated -- read the short passages, here). Likewise, we have a "Window of Opportunity" to get both bills introduced and passed (thus stopping the severe hemorrhaging, where we're bleeding out in having almost 10% of our National Debt as college debt alone!), but that opportunity will not forever be available.

Since I've shown, mathematically, that we did NOT crash the economy during Civil War times by freeing *those* slaves, and that our current situation is less heavy on the economy (even assuming all those 44 Million received total "Loan Forgiveness" -- and that's surely not going to happen to all 100% of collegiate debtors), it is only logical (as Mr. Spock from Star Trek might say) that both my bills be passed into law to avert disaster and prevent my ominous "Crashing the Dollar" prophecies from coming to pass. [_I remind readers that even if we *did* crash the "financial" dollar, we've already crashed our "moral" capitol by passing UNCONSTITUTIONAL Laws that illegally impaired existing contracts -- something you would not like done to yourself, and it can't get any worse than being on the wrong side of GOD, so we have only one direction to go -- UP._]

(E) CURRENT METHODS DON'T work: The costs of college (which was once FREE – or very close to it) have now become unaffordable, and, now ALMOST TEN (10%) PERCENT of total U.S. Debt is college debt. This hurts student AND taxpayers. The definition of “insanity” is for lawmakers to keep doing that which DOESN'T work, and yet expecting different results. – Want to crash the dollar, or have you had enough? Maybe try it MY way, for once, and get the bankruptcy equality and loan limits BACK into law. [Almost $2 Trillion in student debt, paid for by tax dollars, divided by slightly more than $20 Trillion total U.S. debt is almost ten (10%) percent =equals= a “WILL crash the dollar” prediction if not stopped!]

(F) BLACK AMERICANS HURT DISPROPORTIONATELY: “Four years after graduating college, black students owe nearly twice as much student debt as their white peers do and are three times more likely to default on those loans, according to a new paper by the Brookings Institution,” Source: "Black College Grads Have Twice as Much Student Debt as Whites," by Kerri Anne Renzulli, TIME, Oct 21, 2016, LINK: https://TIME.com/money/4540266/student-debt-racial-gap/

(G) ** “A quarter of borrowers who take out student loans end up defaulting within five years...Nationwide, 26% of borrowers defaulted, Pew said.” Source: “1 in 4 Americans defaulted on their student loans, study finds,” by Sarah Min, CBS News: MONEYWATCH, Nov 07, 2019, LINK: https://www.CBSnews.com/news/1-in-4-americans-defaulted-on-their-student-loans-in-five-years/ COMMENTS: Look again, dear reader: This is just in the FIRST FIVE (5) YEARS. Probably, true default rate is closer to 50% or 75% over the lifetime of the loan. See below for more-updated figures to verify...

** Brookings recently reported[a] that defaults run at about 40% for 2004 student loan borrowers, and as those borrowers

were only borrowing one-third[b] of what students are borrowing currently, eventual default rates are probably much

higher, portending a Bubble much larger than the 2008 Housing Bubble.

[a] https://www.brookings.edu/research/the-looming-student-loan-default-crisis-is-worse-than-we-thought/

** “At one end of the spectrum are the active repayers, those who managed to make timely payments without ever postponing payments or becoming delinquent. About 37 percent of borrowers were repaying their loans without taking any mitigating actions, representing almost 667,000 borrowers in 2005 with nearly $13.1 billion in loans. Whether they found making timely payments easy or difficult and whether they restructured their loans into other repayment plans to make the payments more manageable are not captured in the available data. [] The remaining 64 percent—more than 1.1 million borrowers with over $25.3 billion in loans—were not actively repaying their loans for at least a portion of the study period and are likely to be a source of concern to varying extents.” Source: “Delinquency: The Untold Story of Student Loan Borrowing,” by Alisa F. Cunningham and Gregory S. Kienzl, Ph.D, A report prepared by: Institute for Higher Education Policy, March 2011,

Cross-posted: https://www.Bankruptcy-Divorce.com/Bankruptcy-Student-Loan/Delinquency-The_Untold_Story_FINAL_March_2011.pdf

“Fair Use” Cache-1: https://GordonWatts.com/Delinquency-The_Untold_Story_FINAL_March_2011.pdf

“Fair Use” Cache-2: https://GordonWayneWatts.com/Delinquency-The_Untold_Story_FINAL_March_2011.pdf

(H) “Was college once free in United States, as Bernie Sanders says?,” By Amy Sherman on Tuesday, February 9th, 2016 at 4:00 p.m., (Rated: “Mostly True”), PolitiFact, LINK: https://www.PolitiFact.com/florida/statements/2016/feb/09/bernie-s/was-college-once-free-united-states-and-it-oversea/ QUOTE: “Our ruling [] Sanders said, "Making public colleges and universities tuition free, that exists in countries all over the world, used to exist in the United States." []There are at least nine advanced countries that offer free college, including the recent addition of Germany. [] There was a time in the United States when some public colleges and universities charged no tuition. However, tuition has never been set as a national policy -- it is a decision for each school or state government officials. And some colleges charged tuition dating back to the 1800s. [] Sanders' statement is accurate but needs clarification. We rate this statement Mostly True.” COMMENTARY: If we had 'free' college in the past (or real close to it), then MY more-moderate compromises are VERY reasonable, if not outright required to prevent a crash of the dollar, loss of the Senate over to Democrats, and an over-debt-burdened, and under-educated populace, both of which THREATEN National Security.

(I) Over 44 Million Americans have collegiate debt (and more, probably 30—40 Million more, are co-signers / family!! CONSERVATIVE TOTAL: 44M + 40M ~ 84+ Million Americans!?..) Want a “quick” way to anger LOTS of voters? Look no further than HERE → ** https://Breitbart.com/politics/2019/04/12/amnesty-advocates-help-illegal-immigrants-get-college-scholarships-while-44-7-million-americans-saddled-with-student-debt

** https://BusinessInsider.com/millennials-college-not-worth-student-loan-debt-2019-4

With over 44 Million students in debt for college, and another 30 or 40 Million who are cosigners, family, or friends, this is now a crisis bubble, which will burst if not put in check. Prior congresses have kept “kicking the can down the road,” an obvious example of rich colleges and banks having their way with lawmakers, even when a large majority of the public favored bankruptcy—even if not outright “free” college—as new research now confirms is happening: “Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence.” (Abstract paragraph) Source: “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens,” by Martin Gilens and Benjamin I. Page, Perspectives on Politics, Volume 12, Issue 3, pp. 564–581, September 2014, © American Political Science Association 2014, republished with attribution and used under “Fair Use” legal standards, for scholarly criticism & commentary purposes, DOI:10.1017/S1537592714001595,

LINK: https://doi.org/10.1017/S1537592714001595 LINK: https://Scholar.Princeton.edu/sites/default/files/mgilens/files/gilens_and_page_2014_-testing_theories_of_american_politics.doc.pdf

Background stats regarding the 44.7 Million Americans with crushing/oppressive Student Debt, above

To put things into perspective, the Federal Reserve just reported that “Between 2001 and 2016, the real amount of student debt owed by American households more than tripled, from about $340 billion to more than $1.3 trillion,” which, is an increase of more than $960 Billion over a 15-year period, or $64 Billion/year, or $175,222,450.38 each day.

Sources: “Between 2001 and 2016, the real amount of student debt owed by American households more than tripled, from about $340 billion to more than $1.3 trillion.” SOURCE: “FEDS Notes: Student Loan Debt and Aggregate Consumption Growth,” By Laura Feiveson, Alvaro Mezza, and Kamila Sommer, The Federal Reserve, 21 February 2018, Last Update: March 05, 2018, LINK: https://www.FederalReserve.gov/econres/notes/feds-notes/student-loan-debt-and-aggregate-consumption-growth-20180221.htm

And: “Presidential contender wants to wipe out all $1.6T of student loan debt in the US.” SOURCE: “Sanders to Propose 'Revolutionary' End to an 'Absurdity',” By Jenn Gidman, Newser, 24 June 2019, LINK: https://www.Newser.com/story/276912/sanders-plan-that-16t-in-student-loan-debt-gone.html

And: “Americans owe a staggering 1.6 trillion dollars in student loan debt.” SOURCE: “Dozens of Proposals Address Student Loan Debt, but Congress Can't Agree,” By Eva McKend (Washington, D.C.), Spectrum News 1, 11 September 2019, LINK: https://SpectrumNews1.com/ky/louisville/news/2019/09/11/addressing-student-loan-debt-crisis

At a current average interest rate of 4.53% for undergrads (with grads & parent loans even higher), as reported by the U.S. Department of Education (StudentAid.gov), this is over 7.9 Million Dollars of interest alone, each day. Most-importantly, with current student debt predicted to hit two trillion around 2020, according to World.edu, comprising almost ten (10%) of total U.S. Debt, this is a bubble that is bigger than the infamous Housing Crash of 2008. (And even this figure may be an underestimate, since this $2 Trillion figure doesn't include funds students must divert away from retirement savings, parent borrowing, or credit card debt—or even housing debt, which may be “student debt in disguise,” since parents are constantly taking out home equity loans & mortgages to help cover their kids’ educational costs.)

Sources: “The federal student loan interest rate for undergraduates is 4.53% for the 2019-20 school year. Federal rates for unsubsidized graduate student loans and parent loans are higher — 6.08% and 7.08%, respectively.” SOURCE: “Current Student Loan Interest Rates and How They Work,” By Teddy Nykiel, Nerd Wallet, 01 November 2019, LINK: https://www.NerdWallet.com/blog/loans/student-loans/student-loan-interest-rates/ And as verified by https://StudentAid.gov/understand-aid/types/loans/interest-rates

And: “Americans are beginning to realize that student loans pose a big problem. Total student-loan debt is now well over a trillion dollars (and is predicted to hit two trillion around 2020). About a third of young people who are supposed to be making payments on their loans are delinquent, and there is every reason to suspect that a large chunk of what is owed will not be repaid, with taxpayers picking up the tab...Still, something is going to have to give. In the financial world, people warn that someone is going to have to take a haircut (a loss). It is difficult to see how we can resolve the current student-loan problem without everyone—colleges (both for-profit and nonprofit), students, legislators, taxpayers, etc.—taking a haircut. However, we have a choice: Either we can address the problem of student lending as a whole or we can continue to worry about one mess at a time, until we all find ourselves with really bad haircuts.” SOURCE: “Dealing with student loans one mess at a time hasn’t worked,” By Joel and Eric Best, World, 21 March 2014, LINK: https://World.edu/dealing-student-loans-one-mess-time-hasnt-worked/

See also: Actually, a large chunk of housing debt may be “student debt in disguise,” since parents are constantly taking out home equity loans & mortgages to help cover their kids’ educational costs, suggesting Student Debt is closer to TWO ($2,000,000,000,000.oo) TRILION Dollars. Source: “Americans Owe $2 Trillion in Student Loans, We Just Don’t Know it Yet,” By Travis Hornsby, Student Loan Planner, 23 July 2018, LINK: https://www.StudentLoanPlanner.com/student-loans-2-trillion/#Add_it_All_Together_and_We_Could_Easily_be_at_2_Trillion_in_Student_Loans

Editor's Note: Even this figure doesn't tell the full story, however, as the estimated $2 trillion doesn't include funds students must divert away from retirement savings, parent borrowing, or credit card debt.

See also: “From 2006 through 2020, average federal student loan interest rates were: 4.79% for undergraduates 6.36% for graduate students 7.41% for parents and graduate students taking out PLUS loans.” SOURCE: “Average Student Loan Interest Rates in 2020,” By Matt Carter, CREDIBLE, 30 December 2019, LINK: https://www.Credible.com/blog/refinance-student-loans/what-are-average-student-loan-interest-rates/

(J) The Founding Fathers called for uniform bankruptcy laws ahead of the power to raise an army and declare war. Student loans are the ONLY type of loan in this country from which these have been stripped. As I document, in my recent columns, current U.S. Code violates both the Contract Clause (Art.I, Sec.10, Cl.1, U.S. Constitution), the ex post facto Law Clause (Art.I, Sec.10, Cl.1, U.S. Constitution), and the Uniformity Clause (Art.I, Sec.8, Cl.4, U.S. Constitution), a special case of Equal Protection: Current Bankruptcy code is NOT uniform (you ask any college student), and also changes in Federal Law impaired (changed) existing contracts (which, in any other profession, would be illegal, but – like Terri Schiavo – “exceptions” were made as to who is –and is not– protected by the Law). For proof that there WERE changes to Federal Bankruptcy law (that constituted an impairment of existing loan contracts, and thus violation of the Contract Clause, and illegal retroactive changes – a violation of the ex post facto Law Clause, both in Art.I, Sec.10, Cl.1, U.S. Constitution), see e.g., the 'Annotated' notes on my 700-word Ledger column, at either of these mirrors: https://GordonWatts.com/ANNOTATED_700-word_Column-PART-3-Spano.pdf

or: https://gordonWAYNEwatts.com/ANNOTATED_700-word_Column-PART-3-Spano.pdf Or see the testimony of Bankruptcy expert, Atty. Ed Boltz, before the House Judiciary Committee: http://Docs.House.gov/meetings/JU/JU05/20190625/109657/HHRG-116-JU05-Wstate-BoltzE-20190625.pdf

(K) LBJ promised in 1965 that student loans would be “free of interest.” Today, Interest on the nation's student debt grows at $100 Billion per year. (Google this to verify or deny.)

(L) The Federal government is profiting upwards of $50 Billion per year on this program, and even makes a profit on defaulted student loans. (See e.g., Alan Collinge's column, above, to document this.)

(M) Conservatives from places like the National Review, Cato Institute, George Mason University, and Bloomberg (and myself, the undersigned writer – a “far right” Conservative) are calling for the return of bankruptcy rights to student loans. For documentation of this, see my recent letter to The President – posted at The Register (GordonWatts.com / gordonWAYNEwatts.com)

* https://GordonWatts.com/proof-read___Letter-to-the-President_withReferencesAndAttachments_PDF.pdf

(N) BONUS POINT: The Housing Bubble of 2007-2008 was bad, but it would have been much worse had borrowers LACKED bankruptcy (a Free Market check/balance against predatory lending). Student Debt, by contrast, will be a much worse bubble if left unchecked (since borrowers, here, LACK bankruptcy as a Standard Consumer Protection defense).

(O) BONUS POINT: If you look carefully at my political ideology graph (costs of college vs. political ideology), you'll see, clearly, that even though “Free College” is “Liberal” (a 'Liberal' Free Handout), the current costs of college (tuition, shown to be a type of tax, as it's funding going to an arm of government, state colleges, here), the “excessive tax” is FAR more “Liberal” as in “tax-and-spend” liberal. So, while I don't support 'Free College,' even THAT is nowhere as Liberal as the current state of affairs. PROOF: See 'Figure 1' – and 'Updated' Figure 1, at any of these mirrors – posted at The Register:

http://Gordon_Watts.Tripod.com/Higher-Ed-Tuition-Costs.html

(P) COLLEGE Debt is almost TEN (10%) PERCENT of Total Debt – PROOF: Apparently, in response to my column, Sec. of Education, Betsy DeVos, her 11-27-18 speech, 11 days later, repeated my complaints that “Collegiate debt, now almost $2 trillion, is almost 10 percent of total U.S. debt.” I quote her: “Today, FSA's [student debt] portfolio is nearly 10 percent of our nation's debt. [] Stop and absorb that for a moment. Ten percent of our total national debt.”

Fair use archives: www.GordonWatts.com/DeVos-speech_11-27-2018_PDF.pdf

Or: www.gordonWAYNEwatts.com/DeVos-speech_11-27-2018_PDF.pdf

* Two OTHER Constitutional violations are occurring: ILLEGAL Monopoly, and Lack of Notice (Due Process)

(Q) ILLEGAL Monopoly “Legally,” yet another problem exists: U.S. Colleges & Universities hold a monopoly on Higher Education, but it isn't seen (due to the fact that it's so widespread). However, Dictionary.com verifies & proves my claim, as it defines a 'monopoly' as: “exclusive control of a commodity or service in a particular market, or a control that makes possible the manipulation of prices. Compare duopoly, oligopoly.” http://www.Dictionary.com/browse/monopoly – College price-gouging students are more-able if (since) they hold a monopoly (which we all know is illegal). [source: case-law on monopolies – they're illegal, hello?]

(R) Lack of Notice (Due Process) “Legally,” when students were not told of the lack of bankruptcy & other 'standard' consumer protections when taking out the loan (which happened because Truth in Lending requirements were removed), this violated fundamental Federal Due Process, as it is a law void for vagueness, due to the lack of proper notice. [source: Case Law on laws 'Void for Vagueness,' and U.S. Constitution DUE PROCESS rights]

(S) SLAVERY – Redux: We've already seen how oppressive (and illegally-obtained, since it was done deceptively and without Truth in Lending—above) collegiate debt hurts Black Americans, but let's revisit this—REDUX: Some have said that “we paid our loans,” and that existing “debt slaves” (the correct legal term) should pay their **own** freedom. But is this right? ANSWER: No! → Back when President Abraham Lincoln issued the “Emancipation Proclamation,” some existing slaves had already bought (purchased) their own freedom. However, when the rest of the slaves were freed, do you recall any of the “bought my freedom” slaves telling Abe Lincoln to chill out – and make these slaves pay for their own freedoms? NO! They celebrated with them – and rightly so. (Granted, if someone has paid off their college debt and then can't file bankruptcy, perhaps some tax credit would be appropriate, but that is not what happened with even the slavery issue in the Civil War era, and maybe it is not necessary here.)

[ Portions of this page left blank for 'spacing' issues ]

...See below for: “(T) “The Lasting Impact on Students’ Lives” ...

(T) “The Lasting Impact on Students’ Lives” I also found that students who graduate with excessive debt are about 10% more likely to say that it caused delays in major life events, such a buying a home, getting married, or having children. They are also about 20% more likely to say that their debt influenced their employment plans, causing them to take a job outside their field, to work more than they desired, or to work more than one job...What Can Be Done?...Colleges must

also be given better tools to limit student borrowing. For example, college financial aid administrators must be permitted to reduce federal loan limits based on the student’s enrollment status and academic major.” source: “Why the Student Loan Crisis Is Even Worse Than People Think,” TIME, by Mark Kantrowitz http://TIME.com/money/4168510/why-student-loan-crisis-is-worse-than-people-think/ Jan. 11, 2016 –Mark Kantrowitz is one of the nation’s leading student financial aid experts.

→ “ The Lasting Impact on Students’ Lives—Part II ” – “1 in 15 borrowers has considered suicide because of student debt, survey says,” by Alex Tanzi, The Washington Post, May 5, 2019,

→

See

Also:

* “Crushing debt” (Chicago Sun-Times, BY DAVE NEWBART)

September 24, 2007 "Jan Yoder was preparing for her son's

funeral when the phone rang. It was another student loan collector

wanting to know when her son would pay up…It was those calls

and the burden of crushing debt, she

says, that led her depressed son to take the drastic action of

killing himself late last month.

''When it gets to the point where people are fleeing the country,

going off the grid or taking their own lives, you know something has

gone horribly wrong,'' said Alan Collinge, founder of Student Loan

Justice, which is pushing to change student lending

laws.” ~ http://nalert.blogspot.com/2007/09/student-loan-debt-drives-man-to-suicide.html

(Newsalert) See

also: http://StudentLoanJustice.org

*

“I’m

Thinking of Suicide Because of My Student Loans. – John”

(GetOutOfDebt.org, undated news story) “Dear Steve, My student

loans are almost $42,000 dollars. I pay almost $260 dollars per month

and all but $12 dollars is interest and the principal continues to go

higher…I frequently think about suicide; thinking about my son

is the only thing that has so far kept me from committing suicide.

John”http://GetOutOfDebt.org/5493/im-thinking-of-suicide-because-of-my-student-loans-john

*

"A Pastor's Student Loan Debt" (NPR, by Libby Lewis) July

14, 2007 “Dan Lozer's tiny paycheck means he'll be paying off

those loans until 2029...Lozer

said there was a time when he thought about suicide.”

LINK: http://www.npr.org/templates/story/story.php?storyId=11980696

*

“Company’s march toward student loan monopoly scary”

(The News Tribune, By ALAN COLLINGE) 06/19/07 “In Boston; a

medical student can’t get licensed because he can’t pay

$52,000 on what began as a $3,000 debt. A

suicide

in Oregon.

A suicide

in Maryland.

People

who have fled the country

due

to the explosion of their student loan debt.

The list goes on and

on.”http://www.TheNewsTribune.com/opinion/othervoices/story/90638.html See

also: http://StudentLoanJustice.org

[Emphasis

added in Bold-faced and/or underline and/or Red Font for emphasis;

not in original.]

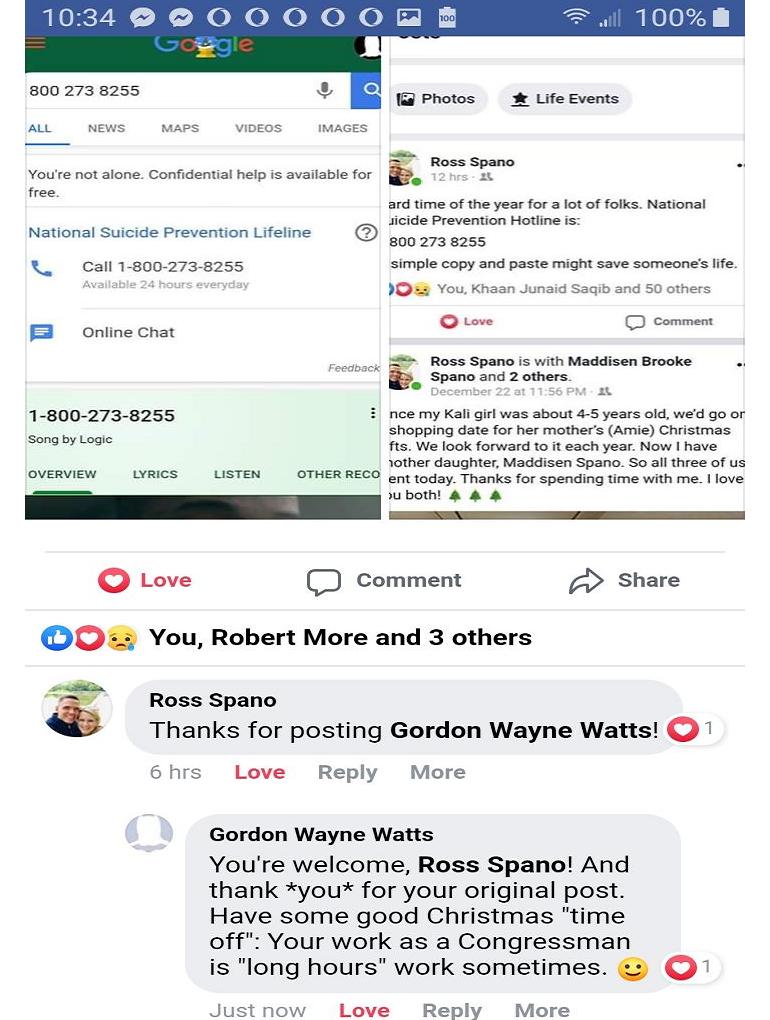

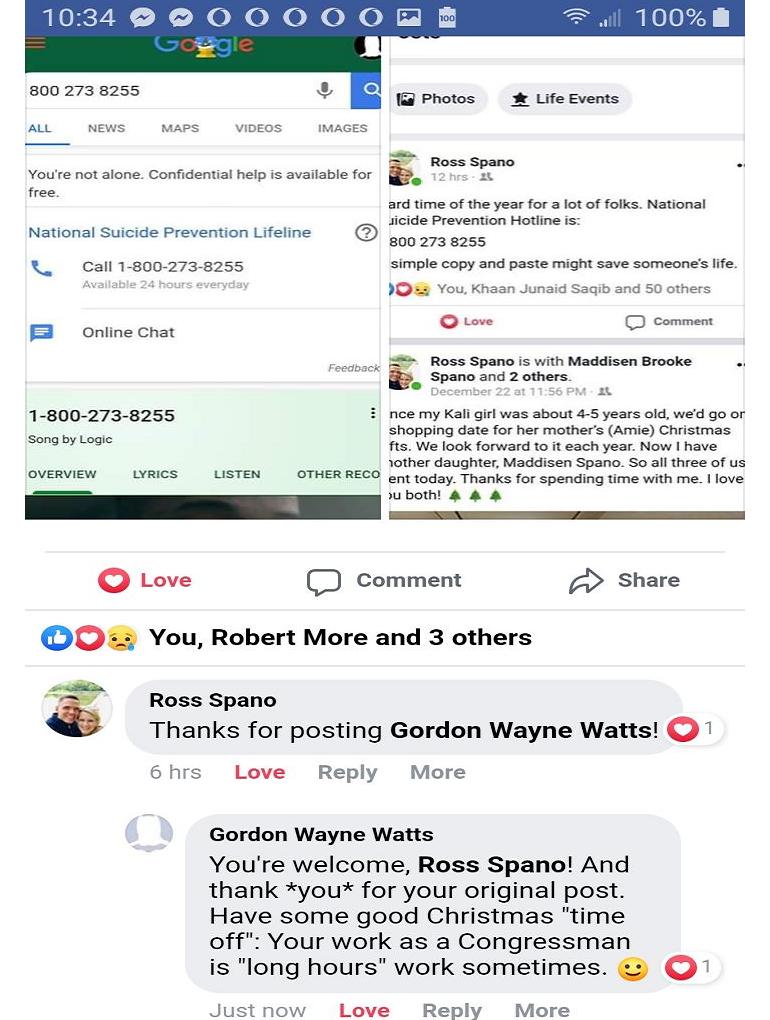

This is a hard time if year for a lot of folks: Holidays are often difficult & emotional.

The NATIONAL SUICIDE PREVENTION HOTLINE IS: 1-800-273-8255

(A simple copy and paste may save someone's life.) Also helpful:

* If you have an emergency, don't be afraid to call 911

* SEEK GOD'S HELP: Fast and pray (Jesus' idea, viz MATTHEW 6:16, 'when' you fast, not 'if' you fast, and that may include a "Facebook fast?" Ask God.)

* COMMUNITY: You have friends. Ask them for help; and, be there when *they* need help. You'll feel better when you help others.

* Healthy diet and lifestyle.

* Take a walk, a warm bath, or a good nap.

* Finish that long-lost project sitting on the shelf; maybe God told you to?..

* Faith in God, family, friends, and repeat this list from the top. SEE SCREENSHOTS FOR CLARIFICATION & VERIFICATION. :-) <3

Tag: Idea for this list in part from my friend, Ross Spano

Gordon Wayne Watts, Plant City and Lakeland, FLORIDA, U.S.A.

(U) UNNECESSARY ADMINISTRATIVE CO$TS for TAXPAYERS!! → “The Department [of Education] and ECMC often oppose an undue hardship discharge for a consumer who could make minimal IDR payments even when there is no likelihood that the consumer’s financial situation will improve or that there will be any meaningful repayment of the student loans. Even when faced with clear evidence that the consumer’s situation is not likely to change, the Department’s position has been that the consumer should wait twenty or twenty-five years in the future to obtain loan forgiveness through the IDR program rather than a seek bankruptcy discharge. This position is fiscally irresponsible as it fails to consider the administrative costs to the Federal government and ultimately taxpayers in keeping the consumer on an IDR plan when there is no anticipated loan repayment. [] This is illustrated by the Department’s actions in In re West.45 The debtor is 60 years old and unemployed. His only income is $194 per month in Supplemental Nutrition Assistance Program (“SNAP”) benefits, and he lives with an aunt who does not charge him rent. The bankruptcy court found the debtor’s testimony to be credible that his criminal background, combined with his age and race, have made it impossible for him to find work. Despite this bleak future, the Department argued that the debtor should not receive a bankruptcy discharge and instead should enroll in an IDR with a $0 payment. [] Simply put, the Department’s policy amounts to throwing good money after bad.” (Source: Written Testimony of John Rao; Attorney, National Consumer Law Center Before the House Judiciary Subcommittee on Antitrust, Commercial, and Administrative Law Oversight of Bankruptcy Law and Legislative Proposals June 19, 2019, LINK: http://Docs.House.gov/meetings/JU/JU05/20190625/109657/HHRG-116-JU05-Wstate-RaoJ-20190625.pdf PAGE:https://Judiciary.House.gov/legislation/hearings/oversight-bankruptcy-law-and-legislative-proposals)

(V) For CHRISTIANS: We must not fail to obey the authorities over us: “13:1 Let every soul be subject to the governing authorities. For there is no authority except from God, and the authorities that exist are appointed by God. 13:2 Therefore whoever resists the authority resists the ordinance of God, and those who resist will bring judgment on themselves. 13:3 For rulers are not a terror to good works, but to evil. Do you want to be unafraid of the authority? Do what is good, and you will have praise from the same.” – Romans 13:1-3, Holy Bible, NKJV [[ The “governing authorities” here INCLUDES the U.S. Constitution's “uniformity” and “contract” clauses, Art. I, Sec. 8, Cl. 4 of the U.S. Constitution, which requires that ANY “bankruptcy” law be UNIFORM, but it is not: You ask ANY college student: Section 523(a)(8) of U.S. Code (the offensive law in question), is NOT “uniform,” DOES violate the U.S. Constitution, and therefore DOES violate God's standards in Romans 13:1-3 ]] – –and the ex post facto Law and Contract Clauses (Art.I, Sec.10, Cl.1, U.S. Constitution).

(W) OLD Testament (Accepted by Jews & Christians) College Tuition is a type of “tax,” because it's monies$$ going to an “arm of the government” (state government colleges, in this case), and, as collegiate tuition is WAAAY to high, it's safe to say that students are being “over-taxed” big time—which “over-taxing” is FORBIDDEN by the God: 1 Samuel 22:1-2 (King David—before he was King—got support from many over-taxed citizen) 1 Kings 11:42-43 ; 1 Kings 12:1-20 (Solomon's EVIL, STUPID son, Rehoboam committed this sin! And it led to civil unrest, and a brief civil war!) 2 Chronicles 9:30-31 ; 2 Chronicles 10:1-19 (Reprise: Solomon's EVIL, STUPID son, Rehoboam))

(X) NEW Testament (Accepted by Christians) “46 And He said, “Woe to you also, lawyers! For you load men with burdens hard to bear, and you yourselves do not touch the burdens with one of your fingers.” “3 Therefore whatever they tell you to observe, that observe and do, but do not do according to their works; for they say, and do not do. 4 For they bind heavy burdens, hard to bear, and lay them on men’s shoulders; but they themselves will not move them with one of their fingers.” [Luke 11:46; Matthew 23:3-4, NKJV, Words of Jesus in red] Commentary: 'Lawyers' & others, such as Federal Lawmakers, who “load men with burdens” (by passing laws stripping students' ability to obtain bankruptcy for most college loans -and stripping 'Truth In Lending' requirements to give borrowers fair 'Due Process' notice of this) certainly violate the Golden Rule. Lawmakers are hypocrites: They wouldn't accept this 'too hard to bear' 'burden' on their shoulders! Plus, just because student can get IBR (“income based repayment”) that doesn't mean everything's alright: [[1]] It takes several days each year to fill out the paperwork, and re-certify, [[2]] Even IF anything's forgiven eventually, it's “taxable” income, [[3]] People with student debt problems can end up with “bad” credit, which makes it much harder to get jobs, and they can lost their driver's licenses and professional licenses if it does to far, and finally, all those lead to [[4]] Excessive stress, which is bad for the health, and of course, reduces earning potential. [[5]] Plus, point (U) above: IBR makes unnecessary administrative co$ts for taxpayers!

** “The “Golden Rule”: ** “...thou shalt love thy neighbour as thyself: I am the LORD.” LEVITICUS 19:18b, Holy Bible, KJV (See also: Leviticus 19:34 – Note: The Christian Old Testament comprises parts of the Jewish Torah)

** “...Thou shalt love thy neighbour as thyself,” MATTHEW 22:39b, MARK 12:31b, Holy Bible, KJV

** “Do to others as you would have them do to you,” LUKE 6:31, Holy Bible, NIV

** “Therefore all things whatsoever ye would that men should do to you, do ye even so to them: for this is the law and the prophets,” MATTHEW 7:12 (KJV) → One more thing from the Christian Holy Bible:

Mark 11:25-26 King James Version (KJV), Holy Bible, Jesus speaking:

25 And when ye stand praying, forgive, if ye have ought against any: that your Father also which is in heaven may forgive you your trespasses. 26 But if ye do not forgive, neither will your Father which is in heaven forgive your trespasses.

[[Gordon says: And this would include student debt being forgiven – either completely or partly through bankruptcy, since we can't call Jesus a liar: “1 At the end of every seven years you shall grant a release of debts. 2 And this is the form of the release: Every creditor who has lent anything to his neighbor shall release it; he shall not require it of his neighbor or his brother, because it is called the LORD’s release…” (HOLY BIBLE, Deuteronomy 15:1-2a, NKJV, see also Deut 15:1-11, and Leviticus 25:13: “In this Year of Jubilee, each of you shall return to his possession,” re: JUBILEE FORGIVENESS)

(Y) ISLAM (Accepted by Muslims) – Moreover, most devout Muslims will recall that Surah 3:130, Surah 4:161, and even Surah al-Rum (The Romans) Quran 30:39 prohibit usury (excessive interest), which is usually present in collegiate loans. See also Al-Baqarah (The Cow), Surah 2:275, THE NOBLE QUR'AN, which has an especially harsh/eternal punishment for: “Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, "Trade is [just] like interest." But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein.”

(Z) LASTLY: The cost of college (already high) get much higher when original loan principal is doubled or tripled due to excessive “interests & fees”: This is forbidden usury (excessive interest) “Charge him no interest or [portion of] increase, but fear your God, so your brother may [continue to] live along with you.” – Leviticus 25:36 and: “7 I thought it over and then rebuked the nobles and officials. I told them, You are exacting interest from your own kinsmen. And I held a great assembly against them. 10 I, my brethren, and my servants are lending them money and grain. Let us stop this forbidden interest! 32b ...we shall not buy it on the Sabbath or on a holy day; and we shall forego raising crops the seventh year [letting the land lie fallow] and the compulsory payment of every debt.” – Nehemiah 5:7; 5:10; 10:32b, Old Testament standards, which are STILL in effect: MATTHEW 5:17 the following: “Think not that I am come to destroy the law, or the prophets: I am not come to destroy, but to fulfil.” See also: “In you they have accepted bribes to shed blood; you have taken [forbidden] interest and [percentage of] increase, and you have greedily gained from your neighbors by oppression and extortion and have forgotten Me, says the Lord God.” Ezekiel 22:12 (Holy Bible, AMP) Note: Forbidden interest (usury, excessive interest) is placed alongside murder & bloodshed, hello!?.. “Not good.”

The excessive (prohibited) Usury is not unlike how Jesus condemned the abuses of the “money changers”:

13 When it was almost time for the Jewish Passover, Jesus went up to Jerusalem. 14 In the temple courts he found people selling cattle, sheep and doves, and others sitting at tables exchanging money. 15 So he made a whip out of cords, and drove all from the temple courts, both sheep and cattle; he scattered the coins of the money changers and overturned their tables. 16 To those who sold doves he said, “Get these out of here! Stop turning my Father’s house into a market!” 17 His disciples remembered that it is written: “Zeal for your house will consume me.”[a] – JOHN 2:13-17, Holy Bible, NIV {Footnotes: [a.]John 2:17, Psalm 69:9}

15 On reaching Jerusalem, Jesus entered the temple courts and began driving out those who were buying and selling there. He overturned the tables of the money changers and the benches of those selling doves, 16 and would not allow anyone to carry merchandise through the temple courts. 17 And as he taught them, he said, “Is it not written: ‘My house will be called a house of prayer for all nations’[a]? But you have made it ‘a den of robbers.’[b]” MARK 11:15-17, Holy Bible, NIV {Footnotes: [a.]Mark 11:17, Isaiah 56:7 [b.]Mark 11:17, Jer. 7:11}

Both the Catholic and Baptist churches condoned slavery, so it's no surprise that they're silent on “debt slavery,” which college students encounter in modern times, but Lawmakers of both parties (including the GOP, my party, many of whom claim to be “Christian” like myself) should forsake their sin and renounce all forms of slavery:

“For many centuries the [Catholic] Church was part of a slave-holding society. The popes themselves held slaves, including at times hundreds of Muslim captives to man their galleys.” Source: “A Church That Can and Cannot Change: The Development of Catholic Moral Teaching,” by John T. Noonan, Jr., as cited in “DEVELOPMENT OR REVERSAL?,” FirstThings, by Avery Cardinal Dulles, October 2005, University of Notre Dame Press, 280 pp., LINK: https://www.FirstThings.com/article/2005/10/development-or-reversal

“The first and oldest educational institution of the Southern Baptist Convention disclosed in a report Wednesday that its four founders together owned more than 50 slaves, part of a reckoning over racism in the nation’s largest Protestant denomination. [] The 71-page report released by the Southern Baptist Theological Seminary is a recitation of decades of bigotry, directed first at African slaves and later at African-Americans.” Source: “Oldest Institution of Southern Baptist Convention Reveals Past Ties to Slavery,” by Adeel Hassan, The New York Times, December 12, 2018, LINK: https://www.NyTimes.com/2018/12/12/us/southern-baptist-slavery.html

CONCLUSION: We won't forever and always have a chance to do that which is right in the sight of the Lord – perhaps we were put here “for such a time as this”: Looking at Esther 4, from the Old Testament Bible (accepted by Jews & Christians alike) → New International Version (NIV) → Esther 4:9:15a →

“9 Hathak went back and reported to Esther what Mordecai had said.10 Then she instructed him to say to Mordecai, 11 “All the king’s officials and the people of the royal provinces know that for any man or woman who approaches the king in the inner court without being summoned the king has but one law: that they be put to death unless the king extends the gold scepter to them and spares their lives. But thirty days have passed since I was called to go to the king.” 12 When Esther’s words were reported to Mordecai, 13 he sent back this answer: “Do not think that because you are in the king’s house you alone of all the Jews will escape. 14 For if you remain silent at this time, relief and deliverance for the Jews will arise from another place, but you and your father’s family will perish. And who knows but that you have come to your royal position for such a time as this?” 15 Then Esther sent this reply...”

CONCLUSION: Just like when your heart is getting operated on, and the doctor MUST address both “input” and “output” of blood to keep you alive, American Higher Ed WON'T work if we refuse to address both excessive taxation (tuition) and excess spending (of tax dollars), which necessitates Rep. Spano – at the VERY LEAST – push both bills into law. (Even that won't be enough, so compromise is out of the question: If you're a Christian like me, read the book of Revelation, the last book in the Bible, about being “lukewarm” and compromising.)

“There is a way which seemeth right unto a man, but the end thereof are the ways of death.” (PROVERBS 14:12; Cf: Proverbs 16:25 Holy Bible, KJV) [ Translation: It only 'seems' right to continue to deprive students of bankruptcy rights, but this method has only allowed student debt—and U.S. Debt—to continue to climb, instead of restoring bankruptcy defense, which would discourage irresponsible, excess predatory lending, skyrocketing tuition, and resultant excess National Debt—which WILL crash the Dollar as the next big bubble, if not put in check—with bankruptcy as a Free Market check on this madness. ]

13 Do not have two differing weights in your bag—one heavy, one light. 14 Do not have two differing measures in your house—one large, one small. 15 You must have accurate and honest weights and measures, so that you may live long in the land the Lord your God is giving you. 16 For the Lord your God detests anyone who does these things, anyone who deals dishonestly. (DEUTERONOMY 25:13-16, Holy Bible, NIV) EDITOR'S NOTE: Two differing bankruptcy standards—which violates the Constitution's UNIFORMITY clause!

35 Ye shall do no unrighteousness in judgment, in meteyard, in weight, or in measure. 36 Just balances, just weights, a just ephah, and a just hin, shall ye have: I am the Lord your God, which brought you out of the land of Egypt. (LEVITICUS 19:34-35, Holy Bible, KJV)

A false balance is abomination to the Lord: but a just weight is his delight. (Proverbs 11:1, Holy Bible, KJV)

9 “‘This is what the Sovereign Lord says: You have gone far enough, princes of Israel! Give up your violence and oppression and do what is just and right. Stop dispossessing my people, declares the Sovereign Lord. 10 You are to use accurate scales, an accurate ephah and an accurate bath. (EZEKIEL 45:9-10, Holy Bible, NIV)

‘Do not pervert justice; do not show partiality to the poor or favoritism to the great, but judge your neighbor fairly. Leviticus 19:15, NIV

“Do not deny justice to your poor people in their lawsuits.” (Exodus 23:6, Holy Bible, NIV)

“You shall do no injustice in court. You shall not be partial to the poor or defer to the great, but in righteousness shall you judge your neighbor. (LEVITICUS 19:15, Holy Bible, ESV)

If thou seest the oppression of the poor, and violent perverting of judgment and justice in a province, marvel not at the matter: for he that is higher than the highest regardeth; and there be higher than they. (Ecclesiastes 5:8, Holy Bible, KJV)

4 Hear this, O ye that swallow up the needy, even to make the poor of the land to fail, 5 Saying, When will the new moon be gone, that we may sell corn? and the sabbath, that we may set forth wheat, making the ephah small, and the shekel great, and falsifying the balances by deceit? 6 That we may buy the poor for silver, and the needy for a pair of shoes; yea, and sell the refuse of the wheat? (AMOS 4:4-6, Holy Bible, KJV)

10 Am I still to forget your ill-gotten treasures, you wicked house, and the short ephah, which is accursed? 11 Shall I acquit someone with dishonest scales, with a bag of false weights? 12 Your rich people are violent; your inhabitants are liars and their tongues speak deceitfully. (MICAH 6:10-12, Holy Bible, NIV)

Did you know that the proverb, above, appears TWICE in the JudeoChristian Old Testament Bible, with only 1 word changed? Yes, and if GOD felt it “bears repeating, so do I; It appears on both Prov. 14:12 and Prov. 16:25. Observe:

“There is a way that seemeth right unto a man, but the end thereof are the ways of death.” PROVERBS 16:25 (Holy Bible, KJV)

Hear God. BELIEVE God. – >> Obey God. “In God We Trust” ?? “One Nation Under God” ?? So help me God!

The Register is Conservative, and we support H.Res.675 [116th Congress (2019-2020)], a Resolution expressing the view that Student Loan Forgiveness (or "Free College") are antithetical to American foundational values of self-responsibility & opportunity. HOWEVER, if Lawmakers could pass (263-171 in the House) the "Mortgage Bailout" (aka: "Emergency Economic Stabilization Act of 2008") outright giving a "Liberal Free (Corporate) Handout" of Seven-Hundred Billion ($700,000,000.oo) Dollars (not counting another $250 Billion and $350 Billion in Sec.115) to companies who made bad decisions, and still have a "Bankruptcy Safety Net," the least they could do is return said safety net to student 'loans'. LIBERAL Lawmakers need to offer relief for taxes dressed up as loans to Student Loan Borrowers, and besides this tax-cut for the middle-class, they need to enact the spending cuts that Trump requested, which would drive down student debt and costs of college, as unlimited subsidies stopped "propping up" a Higher Ed Bubble (which looms larger than the 2008 Housing Bubble, as it lacks Bankruptcy as a Free Market check on excessive taxing/spending).

If we don't obey God, we WILL get a cursed economy. Proof is the current apathy by lawmakers hasn't fixed the problem. (Prior methods worked well –both existence of Constitutional Bankruptcy Equality, as well as refusals to give “student aid” loans to college students on the tax dollar: This WASN'T student aid: It HURT students (higher tuition, when colleges saw students had deep pockets loans) and HURT taxpayers (we will crash the dollar, lose the Senate, & then be unable to enact our GOP agenda, and lose the country, all because we were rebelliously sinful & insisted on committing the “Sin of Rehoboam,” refusing to lighten the load just a little). If we DON'T enact both bills (bankruptcy & spending cuts), we WILL crash the dollar (resulting in the total forgiveness of all loans, since the dollar will have crashed). If we DO enact these bills, we might avert disaster. Gordon Wayne Watts

|

|

For further

information: |

|

* "A Polk Perspective: Fix our bankrupt policy on student debt," By Gordon Wayne Watts, Guest columnist, The Ledger, August 04, 2016, LINK: https://www.TheLedger.com/opinion/20160804/a-polk-perspective-fix-our-bankrupt-policy-on-student-debt FAIR USE CACHE #1: https://GordonWatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Thr04Aug2016.pdf FAIR USE CACHE #2: https://GordonWAYNEwatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Thr04Aug2016.pdf

* "Polk Perspective: Rescue taxpayers from mounting student debt," By Gordon Wayne Watts, Guest columnist, The Ledger, November 16, 2018, LINK: https://www.TheLedger.com/opinion/20181116/polk-perspective-rescue-taxpayers-from-mounting-student-debt FAIR USE CACHE #1: https://GordonWatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Fri16Nov2018.pdf FAIR USE CACHE #2: https://GordonWAYNEwatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Fri16Nov2018.pdf

* "Polk Perspective: Offer relief for taxes dressed up as ’loans’," By Gordon Wayne Watts, Guest columnist, The Ledger, November 19, 2019, LINK: https://TheLedger.com/opinion/20191119/polk-perspective-offer-relief-for-taxes-dressed-up-as-loans FAIR USE CACHE #1: https://GordonWatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Tue19Nov2019.pdf FAIR USE CACHE #2: https://GordonWAYNEwatts.com/TheLedger-Online-PDF-FairUse-cache-WATTS-GuestColumn-Tue19Nov2019.pdf

See also news at https://GordonWatts.com or https://GordonWayneWatts.com

|

You wouldn't like me when I'm angry... Because I always back up my rage with facts a |

“Inside” links: * https://Facebook.com/GordonWayneWatts * https://YouTube.com/GordonWayneWatts * https://Twitter.com/Gordon_W_Watts

“Outside” links: * https://StudentLoanJustice.org (Official page) * https://Twitter.com/AlanSLJ (Regularly-updated Twitter feed) * https://m.Facebook.com/groups/SLJGroup (Facebook group for Mobile devices/iPhones) * https://Facebook.com/groups/SLJGroup (Facebook group)

Gordon Wayne Watts https://GordonWatts.com https://GordonWayneWatts.com Editor-in-Chief, The Register “No,

His 100TH birthday was last month. Now, he's

celebrating paying off his Student Loans!” |

BONUS page of hard science – research... things to consider:

** “Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence.” (Abstract paragraph) Source: “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens,” by Martin Gilens and Benjamin I. Page, Perspectives on Politics, Volume 12, Issue 3, pp. 564–581, September 2014, © American Political Science Association 2014, republished with attribution and used under “Fair Use” legal standards, for scholarly criticism & commentary purposes,

DOI:10.1017/S1537592714001595, LINK: https://doi.org/10.1017/S1537592714001595

(More detailed quotes from above paper) >> “In any case, the imprecision that results from use of our “affluent” proxy is likely to produce underestimates of the impact of economic elites on policy making. If we find substantial effects upon policy even when using this imperfect measure [top ten percent earners], therefore, it will be reasonable to infer that the impact upon policy of truly wealthy citizens [top 2%] is still greater.” p.569, par. 2 [[Editor's note: In an ideal democracy, all citizens should have equal influence on government policy--but as this research paper demonstrates, America's policymakers respond almost exclusively to the preferences of the economically advantaged.]]

Point: While rich & middle-class agree on many things, when they disagree, the rich win more often, and the “super rich” win even more—almost ALL the time: “As noted, our evidence does not indicate that in U.S. policy making the average citizen always loses out. Since the preferences of ordinary citizens tend to be positively correlated with the preferences of economic elites, ordinary citizens often win the policies they want, even if they are more or less coincidental beneficiaries rather than causes of the victory.” pp.572–573

“We report on an effort to do so, using a unique data set that includes measures of the key variables for 1,779 policy issues. [] Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence.” Abstract paragraph

“Further, the issues about which economic elites and ordinary citizens disagree reflect important matters, including many aspects of trade restrictions, tax policy, corporate regulation, abortion, and school prayer, so that the resulting political losses by ordinary citizens are not trivial. Moreover, we must remember that in our analyses the preferences of the affluent are serving as proxies for those of truly wealthy Americans, who may well have more political clout than the affluent, and who tend to have policy preferences that differ more markedly from those of the average citizens. Thus even rather slight measured differences between preferences of the affluent and the median citizen may signal situations in which economic-elites want something quite different from most Americans and they generally get their way.” p.573

“Thus when popular majorities favor the status quo, opposing a given policy change, they are likely to get their way; but when a majority—even a very large majority—of the public favors change, it is not likely to get what it wants. In our 1,779 policy cases, narrow pro-change majorities of the public got the policy changes they wanted only about 30 percent of the time. More strikingly, even overwhelmingly large pro-change majorities, with 80 percent of the public favoring a policy change, got that change only about 43 percent of the time. [] In any case, normative advocates of populistic democracy may not be enthusiastic about democracy by coincidence, in which ordinary citizens get what they want from government only when they happen to agree with elites or interest groups that are really calling the shots. When push comes to shove, actual influence matters.” p.573

“Organized Interest Groups

Our findings of substantial influence by interest groups is particularly striking because little or no previous research has been able to estimate the extent of group influence while controlling for the preferences of other key nongovernmental actors. Our evidence clearly indicates that—controlling for the influence of both the average citizen and economic elites—organized interest groups have a very substantial independent impact upon public policy...[] Here, too, the imperfections of our measure of interest-group alignment (though probably less severe than in the case of economically-elite individuals) suggest, a fortiori, that the actual influence of organized groups may be even greater than we have found.” p.574

“When the preferences of economic elites and the stands of organized interest groups are controlled for, the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.” p.575

“What do our findings say about democracy in America? They certainly constitute troubling news for advocates of “populistic” democracy, who want governments to respond primarily or exclusively to the policy preferences of their citizens. In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes. When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system, even when fairly large majorities of Americans favor policy change, they generally do not get it. [] A possible objection to populistic democracy is that average citizens are inattentive to politics and ignorant about public policy; why should we worry if their poorly-informed preferences do not influence policy making? Perhaps economic elites and interest-group leaders enjoy greater policy expertise than the average citizen does. Perhaps they know better which policies will benefit everyone, and perhaps they seek the common good, rather than selfish ends, when deciding which policies to support. [] But we tend to doubt it. We believe instead that—collectively—ordinary citizens generally know their own values and interests pretty well, and that their expressed policy preferences are worthy of respect.” p.576